Understanding the Legal and Tax Considerations of Real Estate Investments in Europe

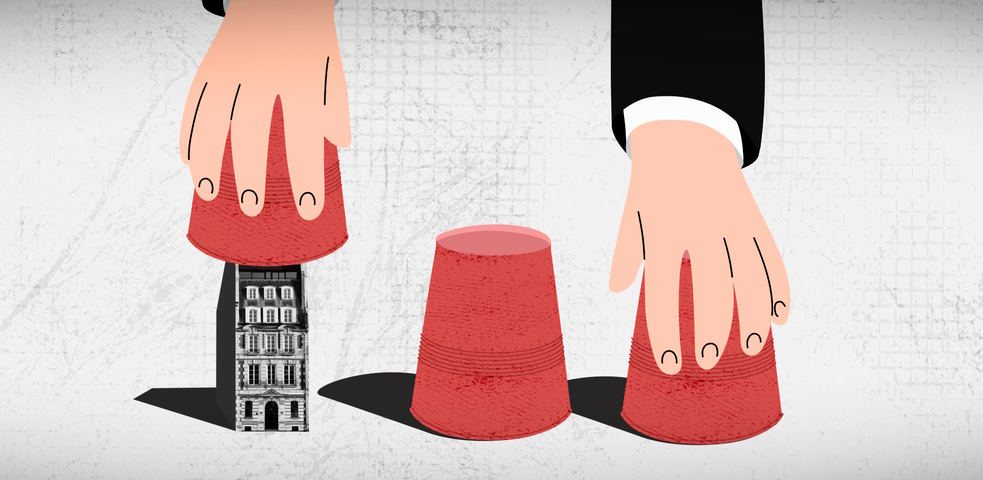

Real estate investments in Europe offer attractive opportunities for investors seeking diversification and potential returns. However, navigating the legal and tax landscape in Europe can be complex and challenging, with varying legal systems and tax regimes across different countries. Understanding the legal and tax considerations is essential for making informed investment decisions and maximizing returns. This article aims to provide an overview of the key legal and tax considerations of real estate investments in Europe. It will explore the diverse legal and tax landscape in Europe, highlight common legal and tax challenges, and provide strategies for mitigating risks and optimizing tax efficiency. By gaining a comprehensive understanding of the legal and tax landscape, investors can effectively navigate the complexities of real estate investments in Europe and increase their chances of success.

Legal Considerations for Real Estate Investments in Europe

Real estate investments in Europe can present lucrative opportunities, but navigating the legal landscape requires careful consideration. One of the main challenges is the diversity of legal systems across European countries, which can have a significant impact on real estate investments. From property ownership laws to land use regulations and zoning laws, understanding the legal framework is crucial for successful investments.

Different legal systems in European countries can vary greatly in their approach to property ownership. Some countries may have strict regulations on foreign ownership of real estate, while others may have more lenient rules. It is essential for investors to thoroughly understand the legal framework around property ownership in the country of their investment to ensure compliance and avoid any legal hurdles.

Land use regulations and zoning laws are other critical legal considerations for real estate investments in Europe. These regulations dictate how land can be used, developed, and built upon, and can greatly impact the potential profitability of a real estate investment. Investors need to be familiar with the local land use regulations and zoning laws to ensure that their investment aligns with the permitted usage, and to avoid any potential legal issues.

Conducting thorough due diligence on legal matters is crucial before investing in European real estate. This includes reviewing legal documents, contracts, permits, licenses, and other legal requirements associated with the property. Engaging with local legal experts who are knowledgeable about the legal landscape in the specific country or region is advisable to ensure that all legal aspects are thoroughly vetted.

Real estate investments in Europe may also face legal challenges that can have significant implications. For example, disputes related to property boundaries, lease agreements, or construction permits can impact the profitability and viability of an investment. Understanding the potential legal challenges and having contingency plans in place can help investors mitigate risks and protect their investments.

Real-world case studies can provide valuable insights into the legal challenges faced by real estate investors in Europe. For instance, a case study might highlight how a lack of understanding of local property ownership laws resulted in a failed investment, or how a legal dispute over land use regulations impacted the profitability of a real estate project. These examples illustrate the importance of thorough legal due diligence and compliance with local legal requirements in European real estate investments.

Tax Considerations for Real Estate Investments in Europe

When it comes to real estate investments in Europe, understanding the tax landscape is crucial for investors to effectively manage their investments and optimize returns. European countries have varying tax systems that can significantly impact the profitability and tax efficiency of real estate investments.

One key tax consideration for real estate investments in Europe is property taxes. Different countries have their own property tax regimes, which may include annual property taxes based on the value of the property or other factors such as location or usage. Investors need to be aware of the local property tax laws and their implications on the cash flow and overall profitability of their real estate investment.

Capital gains taxes are another important tax consideration for real estate investments in Europe. When a property is sold, capital gains tax may be imposed on the profit earned from the sale. The rates and exemptions for capital gains tax vary across European countries, and it is crucial for investors to understand these tax implications and plan their investments accordingly.

Value-added tax (VAT) is another significant tax consideration for real estate investments in Europe. VAT may be applicable on the sale of new properties or on certain services related to real estate transactions, such as construction or renovation. The VAT rates and exemptions can differ among countries, and understanding the local VAT laws is essential to avoid unexpected tax liabilities.

Investors should also be aware of tax incentives and exemptions available for real estate investments in Europe. Some countries offer tax incentives for certain types of real estate investments, such as renovation of historic buildings, affordable housing, or renewable energy projects. Understanding these incentives and exemptions can help investors optimize their tax position and enhance the profitability of their investments.

Engaging with tax professionals and structuring investments to optimize tax efficiency is crucial for real estate investments in Europe. Tax laws can be complex and subject to change, and having expert guidance can help investors navigate the intricacies of the tax landscape and ensure compliance with local tax regulations.

Real-world case studies can provide valuable insights into the tax challenges faced by real estate investors in Europe. For example, a case study might highlight how changes in local property tax laws impacted the cash flow of a real estate investment, or how a lack of understanding of local VAT laws resulted in unexpected tax liabilities. These examples emphasize the importance of thorough tax planning and compliance with local tax requirements in European real estate investments.